Investors are trying to read the tea leaves in a choppy U.S. stock market to gauge whether its recent run higher can continue after Federal Reserve Chair Jerome Powell unleashed bullish sentiment at the end of November by indicating its aggressive interest rate hikes could slow.

“The leadership of the stock market is telling you that the economy isn’t going to collapse under the weight of the Fed in the near term,” said Andrew Slimmon, a senior portfolio manager for equities at Morgan Stanley Investment Management, in a phone interview. “I think you’re going to get a strong market into year-end.”

Slimmon pointed to the outperformance of cyclical sectors of the market, including financials, industrials, and materials over the past couple months, saying that those sectors “would be rolling over dying” if the economy and corporate earnings were on the verge of collapse.

The U.S. added a robust 263,000 new jobs in November, exceeding the forecast of 200,000 from economists polled by The Wall Street Journal. The unemployment rate was unchanged at 3.7%, the U.S. Bureau of Labor Statistics reported Friday. That’s near a half-century low. Meanwhile, hourly pay rose 0.6% last month to an average of $32.82, the report shows.

The “resilience” of the labor market and “resurgence in wage pressures” won’t keep the Fed from slowing its pace of rate hikes this month, Capital Economics said in an emailed note Friday. Capital Economics said it’s still expecting the central bank to reduce the size of its next interest rate hike in December to 50 basis points, after a string of 75-basis-point increases.

“In the bigger picture, a strong job market is good for the economy and only bad because of the Fed’s mission to stifle inflation,” said Louis Navellier, chief investment officer at Navellier, in a note Friday.

The Fed has been lifting its benchmark interest rate in an effort to tame high inflation that showed signs of easing in October based on consumer-price index data. This coming week, investors will get a reading on wholesale inflation for November as measured by the producer-price index. The PPI data will be released Dec. 9.

“That will be an important number,” said Slimmon.

The producer-price index is much more driven by supply issues than consumer demand, according to Jeffrey Kleintop, Charles Schwab’s chief global investment strategist.

“I think the PPI pressures have peaked out based on the decline we’ve seen in supply chain problems,” Kleintop said in a phone interview. He said that he’s expecting that the upcoming PPI print may reinforce the overall message of central banks stepping down the pace of rate hikes.

This coming week investors will also be keeping a close watch on initial jobless claims data, due out Dec. 8, as a leading indicator of the health of the labor market.

“We are not out of the woods,” cautioned Morgan Stanley’s Slimmon. Although he’s optimistic about the stock market in the near term, partly because “there’s a lot of money on the sidelines” that could help fuel a rally, he pointed to the Treasury market’s inverted yield curve as reason for concern.

Inversions, when shorter-term Treasury yields rise above longer-term rates, historically have preceded a recession.

“Yield curves are excellent predictors of economic slowdowns, but they’re not very good predictors of when it will happen,” Slimmon said. His “suspicion” is that a recession could come after the first part of 2023.

‘Massive technical recovery’

Meanwhile, the S&P 500 index closed slightly lower Friday at 4,071.70, but still booked a weekly gain of 1.1% after surging Nov. 30 on Powell’s remarks at the Brookings Institution indicating that the Fed may downshift the size of its rate hikes at its Dec. 13-14 policy meeting.

“The bears disparaged” the Powell-induced rally, saying his speech was “hawkish and didn’t justify the market’s bullish spin,” Yardeni Research said in a note emailed Dec. 1. But “we believe that the bulls correctly perceive that inflation peaked this summer and were relieved to hear Powell say that the Fed might be willing to let inflation subside without pushing the economy into a recession.”

While this year’s inflation crisis has led investors to focus “solely on danger, not opportunity,” Powell was signaling that it’s time to look at the latter, according to Tom Lee, head of research at Fundstrat Global Advisors, in a note Friday morning. Lee already had been bullish ahead of Powell’s Brookings speech, detailing in a Nov. 28 note, 11 headwinds of 2022 that have ‘flipped.’

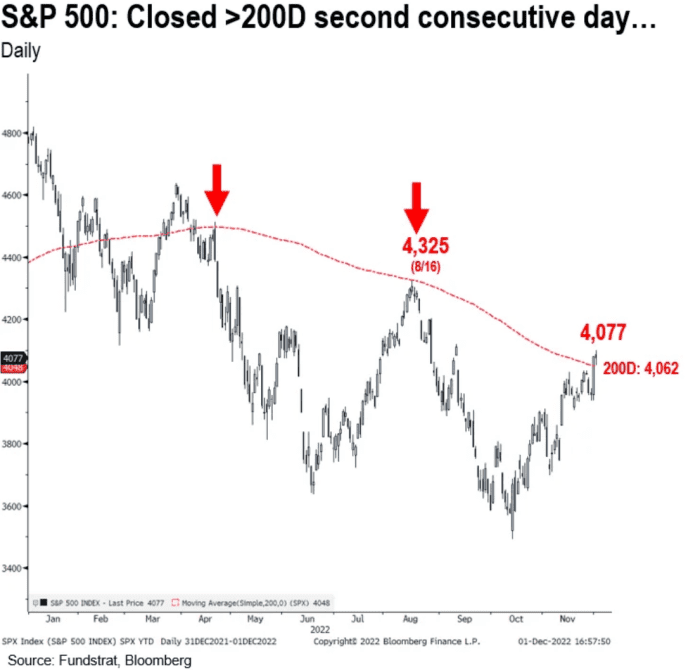

The S&P 500 has clawed its way back above its 200-day moving average, which Lee highlighted in his note Friday ahead of the stock market’s open. He pointed to the index’s second straight day of closing above that moving average as a “massive technical recovery,” writing that “in the ‘crisis’ of 2022, this has not happened (see below), so this is a break in pattern.”

FUNDSTRAT GLOBAL ADVISORS NOTE FROM MORNING OF DEC. 2, 2022

On Friday, the S&P 500

SPX,

again closed above its 200-day moving average, which then stood at 4,046, according to FactSet data.

Navellier said in a note Friday that the 200-day moving average was “important” to watch that day as whether the U.S. stock-market benchmark finished above or below it could “lead to further momentum in either direction.”

But Charles Schwab’s Kleintop says he might “put a little less weight on the technicals” in a market that’s currently more macro driven. “When a simple word from Powell could push” the S&P 500 above or below the 200-day moving average, he said, “this is maybe not as much driven by supply or demand of equity by individual investors.”

Kleintop said he’s eyeing a risk to the equity market next week: a price cap on Russian oil that could take effect as soon as Monday. He worries about how Russia may respond to such a cap. If the country moves to withhold oil from the global market, he said, that could cause “oil prices

CL.1,

to shoot back up again” and add to inflationary pressures.

Read: G-7 and Australia join EU in setting $60-per-barrel price cap on Russian oil

Navellier, who said a “soft landing is still possible” if inflation falls faster than expected, also expressed concern over energy prices in his note. “One thing that may re-ignite inflation would be a spike in energy prices, which is best hedged by overexposure to energy stocks,” he wrote.

“Volatility is likely to remain high,” according to Navellier, who pointed to “the Fed’s resolve to keep tapping the brakes.”

U.S. stocks have taken some big swings lately, with the S&P 500 climbing more than 5% last month after jumping 8% in October and sliding more than 9% in September, FactSet data show. Major benchmarks ended mixed Friday, but the S&P 500, Dow Jones Industrial Average

DJIA,

and technology-heavy Nasdaq Composite

COMP,

each rose for a second straight week.

“Keep the bias to quality earners,” said Navellier, “taking advantage to add on pullbacks.”