The Dow Jones Industrial Average contains 30 blue chip companies, almost all of which pay dividends. And while the index yields more than the S&P 500 and Nasdaq Composite, there are only two of its stocks that yield over 5%.

Verizon Communications (NYSE: VZ) is one of them, with a 6.5% yield. The other is commodity chemical company Dow (NYSE: DOW).

It has nothing to do with the “Dow” in the Dow Jones Industrial Average. Confusion aside, here’s why Dow is an excellent undervalued high-yield dividend stock.

Dow is in a downturn

Dow has four main segments: packaging, infrastructure, consumer, and mobility. No matter the segment or customer, the company’s objective is to make chemicals used in plastics, seals, foams, gels, adhesives, resins, coatings, and the like for the lowest price possible.

Unlike a specialty chemical company, like DuPont, or Corteva, which caters to the agriculture industry, Dow’s differentiating factors are its procurement, manufacturing, and distribution — not so much making a unique product that its competitors can’t match.

A disadvantage of Dow’s model is that it is heavily dependent on demand and prone to downturns. It is also vulnerable to global supply chains and geopolitical risks.

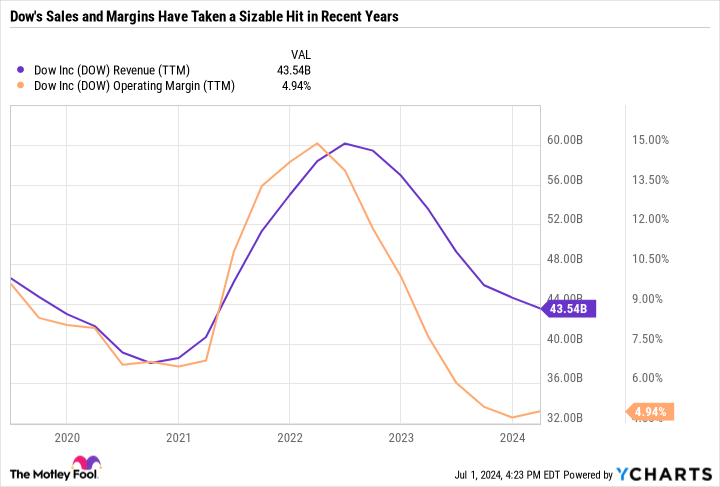

Sales and margins surged in late 2021 and early 2022 as demand recovered from the COVID-induced slowdown. But since then, Dow’s sales and operating margins have been crushed, with operating margins falling from around 15% to 5% in just two years.

Dow discussed the demand dynamics for ethylene and polyethylene in detail on its first-quarter 2024 earnings call, saying that cash margins in China remain negative, pressuring suppliers. However, the company has a cost advantage, and management is confident it is beginning to turn the corner.

Despite a challenging quarter, the company reiterated its guidance for achieving $6.4 billion in earnings before interest, taxes, depreciation and amortization (EBITDA) for 2024, which would be a substantial improvement from $4.01 billion in 2023 EBITDA.

Returning to growth

Dow has been investing heavily in low-carbon efforts and new markets. The energy transition is a potential catalyst, including chemicals and materials to make electric vehicles, and lower-emission electric-powered cracking furnaces used in chemical production. By 2030, the company expects to grow capacity by 20%, EBITDA by over $3 billion per year, and reduce its directly and indirectly produced emissions by 15% compared to 2020 levels.

In its May investor presentation, management said that its near-term growth investments since 2021 have already added $800 million per year in incremental mid-cycle EBITDA.

Dow’s Path2Zero hydrogen-fueled cracking plant in Alberta, Canada, is expensive but could help the company achieve its economic and environmental targets. On the first-quarter earnings call, it said that the project could deliver even higher returns than its Texas-9 cracker, which was instrumental in helping achieve record earnings in 2021.

In addition to the whims of the business cycle, it’s important to understand that Dow’s earnings can swing wildly based on the timing of its investments. Right now, the company is in expansion mode, and capital expenditures are their highest since Dow, DuPont, and Corteva spun off into independent companies in April 2019.

The good news is that Dow took advantage of outsize earnings by paying down debt. It has reduced its net debt and pension liability by $9 billion over the last five years, with 99% of long-term debt at fixed rates.

A business built for returning capital

Dow has been a rather unimpressive stock. Since spinning off from DowDuPont in April 2019, the stock price has gone practically nowhere. The quarterly dividend has also stayed the same at $0.70 or $2.80 per share annually — good for a forward yield of 5.3%.

A lack of dividend raises often indicates that the payout is unaffordable. But as mentioned above, Dow is undergoing a period of capital investments that it believes will lead to more earnings growth over time.

It also has clearly stated capital-return goals, with a dividend policy that targets a 45% payout of operating net income and a 65% payout of operating net income through dividends plus share buybacks. As earnings grow over time, we can expect the dividend to also grow. For now, the 5.3% yield is a worthwhile incentive to hold the stock.

Load up on Dow stock for a reliable high yield

The investment thesis for Dow since the spinoff has centered almost entirely around the dividend. And over the short term, it wouldn’t be surprising to see the stock price continue to languish. But management is making the right long-term investments to capitalize on the energy transition, while also improving its balance sheet. It is progressing well on its 2030 targets, for which investors should continue to hold it accountable.

The valuation also looks incredibly attractive. Analyst consensus estimates are for $2.95 in 2024 earnings per share and $4.18 in 2025 as the company returns to growth. Based on its 2024 earnings, Dow would have a price-to-earnings ratio under 18, which is inexpensive considering it is coming off a weak year.

All told, Dow checks a lot of boxes for income and value investors, making it a worthwhile passive-income play to consider now.

Should you invest $1,000 in Dow right now?

Before you buy stock in Dow, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dow wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $786,046!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 2, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

Should You Buy the Second-Highest Yielding Stock in the Dow Jones Industrial Average? was originally published by The Motley Fool